Let’s be real—crypto taxes can feel like a nightmare. But the truth is, if you’re trading, selling, or earning crypto, you might owe taxes. The big question is: what exactly gets taxed, and are there any loopholes?

Let’s break it down in plain English so you don’t get caught off guard in 2025. Uncover insights with KwickBit!

Crypto Tax Rules Around the World

United States

If you’re in the US, the IRS sees crypto as property, meaning most transactions are taxable. You’ll need to report if you:

- Sell crypto for regular cash (USD, EUR, etc.)

- Swap one coin for another (BTC to ETH, for example)

- Buy stuff with crypto

- Earn crypto from mining, staking, or as a salary

- Receive rewards, airdrops, or forks

What’s not taxed? Holding crypto, transferring between your own wallets, and gifting below $15,000 per year. Not too bad, right?

United Kingdom

The UK treats crypto as an asset, so you’re looking at Capital Gains Tax (CGT) when you sell or trade. If you’re getting paid in crypto or mining it, expect to pay Income Tax too.

Europe & Other Countries

- Germany: No tax if you HODL for over a year. Easy win!

- France: Crypto-to-crypto swaps? Tax-free. But cashing out? Taxed.

- Brazil: Monthly crypto tax reports are a must.

- Singapore: No capital gains tax at all (yes, really!).

- China: No official tax policy yet, but that could change anytime.

Moral of the story? Where you live seriously affects how much tax you’ll pay.

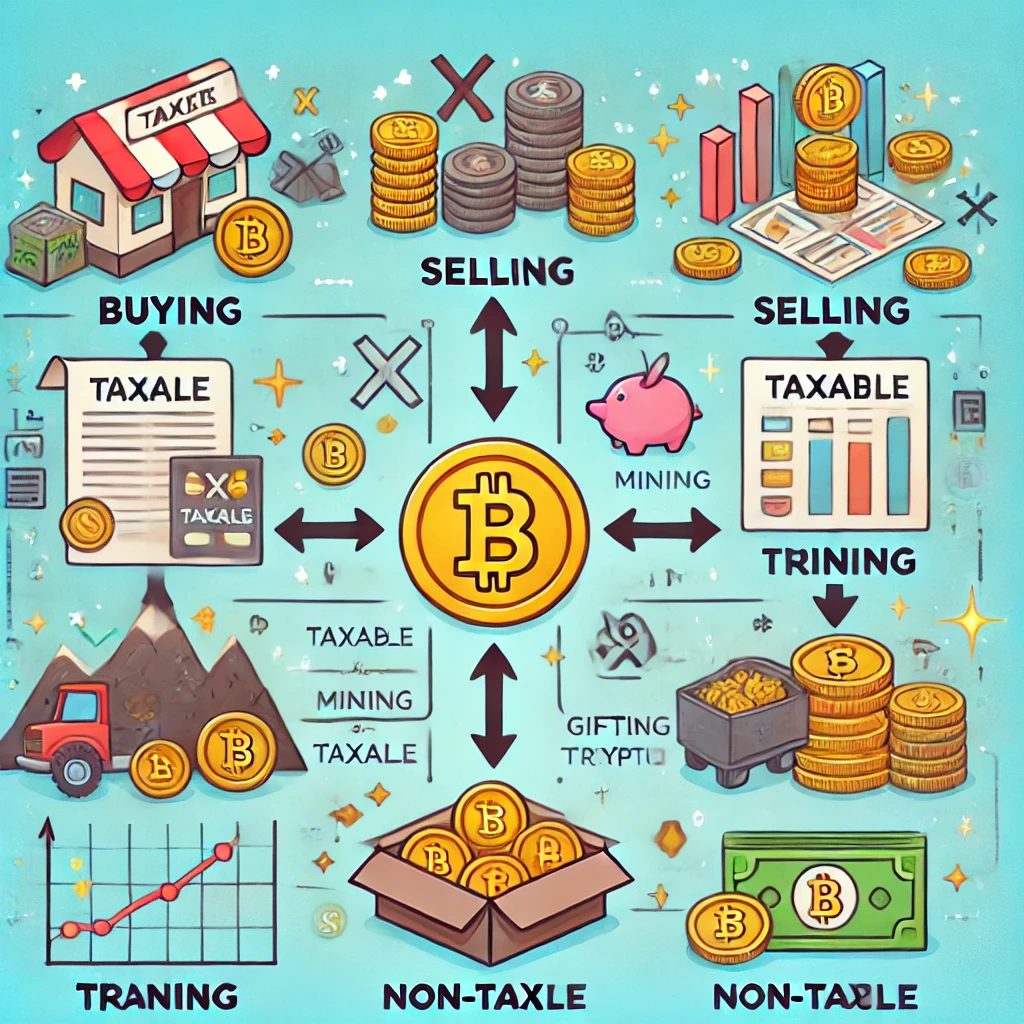

What Crypto Transactions Are Taxable?

Taxable Crypto Transactions

- Selling crypto for fiat (like USD or EUR)

- Swapping one coin for another (BTC to SOL, for example)

- Paying for stuff with crypto

- Mining, staking, and getting paid in crypto

- Airdrops and hard forks (yep, free money still gets taxed)

Tax-Free Crypto Transactions

- Holding crypto (as long as you don’t sell or trade)

- Gifting crypto (within limits)

- Moving crypto between your own wallets

- Buying crypto with cash (you get taxed only when you sell for a profit)

Not everything comes with a tax bill, but most things do. Keep track!

How to Report Crypto Taxes

Filing crypto taxes isn’t fun, but it’s gotta be done. Here’s how to keep it simple:

- Track Everything

- Use crypto tax software like CoinTracking or Koinly.

- Keep records of how much you paid, when, and what for.

- Calculate Gains & Losses

- Profit from selling? That’s a capital gain.

- Lost money? That can reduce your taxable income (silver lining!).

- File the Right Forms

- In the US, that’s Form 8949 and Schedule D.

- In the UK, report crypto gains on your Self Assessment Tax Return.

- If you’re not sure, get a tax pro to help you out.

Avoiding Crypto Tax Mistakes

Common Mistakes That Could Cost You

- Not reporting your trades (governments are tracking wallets now!)

- Forgetting that swaps are taxable (even if you didn’t cash out)

- Ignoring staking and mining income

- Thinking personal wallets mean tax-free (spoiler: they don’t)

Pro Tips to Stay on the Safe Side

✔️ Use a crypto tax calculator to make life easier

✔️ Report all taxable transactions, even the small ones

✔️ HODL for a year or more if you’re in a country with tax breaks

✔️ Talk to a tax expert if you’re dealing with big money moves

Where to Find More Crypto Tax Info

Want to dig deeper? Here are some solid resources:

If you’re still figuring out where to store your crypto safely, check out our guide on best crypto wallets for secure storage!

Conclusion

So now you’ve reviewed about Cryptocurrency Tax Rules: Everything You Need to Know. KwickBit hopes this article will provide you with more useful information.

Crypto taxes aren’t going away, so staying informed is the best move. Whether you’re trading, investing, or getting paid in crypto, make sure you track everything and file your taxes properly.

Final pro tip? Use tax software or get an expert involved if things get complicated. You don’t want the IRS or HMRC knocking on your door. Stay smart, stay compliant, and keep stacking those sats!

KwickBit – Non-custodial Payment Gateway

Read more: