The rise of Decentralized Finance (DeFi) is reshaping the way businesses and consumers interact with money. DeFi uses blockchain technology to offer a decentralized alternative to traditional finance, cutting out middlemen and offering secure, transparent financial services.

As we dive into the future of DeFi Payments, it’s clear that crypto payments are an essential part of this revolution, unlocking exciting new opportunities for businesses worldwide. Uncover insights with KwickBit!

The History of DeFi Payments

DeFi has come a long way since its inception. In 2017, Ethereum’s smart contract capabilities enabled the first wave of decentralized applications (dApps). These applications allowed users to access financial services—such as lending, borrowing, and trading—without relying on centralized authorities like banks or payment processors.

The success of platforms such as MakerDAO, Compound, and Uniswap demonstrated the potential of decentralized finance, inspiring more businesses and individuals to explore blockchain-based financial services. With transparent, secure, and efficient systems in place, DeFi quickly gained traction across industries, promising an alternative to traditional banking.

Current Adoption of Crypto Payments

As blockchain technology matures, the adoption of crypto payments continues to rise. Industries including e-commerce, travel, and gaming are embracing cryptocurrencies, with companies like Shopify, Travala, and MonoVM leading the way. These businesses recognize the benefits of crypto payments, offering their customers faster, cheaper, and more secure transactions.

Benefits of Crypto Payments for Businesses

- Enhanced Security

Blockchain’s inherent security features, such as encryption and immutability, make crypto payments highly secure. Fraud risks and chargebacks are reduced since transactions are irreversible and transparent, providing greater trust for both businesses and consumers. - Lower Transaction Fees

Traditional payment processors often charge high fees for international transactions, currency conversion, and chargebacks. With crypto payments, businesses can bypass these fees, lowering overhead costs and potentially passing on savings to customers. - Faster Transactions

Cryptocurrency transactions can be processed almost instantaneously, eliminating the delays and high fees typically associated with traditional financial systems. For cross-border transactions, DeFi platforms offer near-instant settlement times, which can significantly improve cash flow for businesses. - Access to New Markets

By accepting cryptocurrencies, businesses open themselves to a global customer base, including people who may not have access to traditional banking services. Cryptocurrencies transcend geographical boundaries, allowing companies to tap into emerging markets and increase their revenue streams.

The Future of Crypto Payments and DeFi

As DeFi continues to grow, it faces several challenges. However, innovative solutions are emerging that address these issues, paving the way for even wider adoption.

Scaling Solutions for Increased Speed and Efficiency

Currently, blockchain networks, especially Bitcoin and Ethereum, face challenges related to transaction speed and network congestion. However, scaling solutions are being developed to overcome these limitations.

- Layer 2 Solutions: The Lightning Network for Bitcoin and Optimistic Rollups for Ethereum are designed to scale transaction throughput by processing transactions off-chain and settling them on-chain. These solutions enhance speed, reduce costs, and increase efficiency.

- Sharding: Ethereum 2.0 introduces sharding, where the network is divided into smaller, more manageable pieces called “shards.” This enables parallel processing of transactions, dramatically improving scalability and transaction speeds.

- Interoperability Protocols: Projects like Polkadot and Cosmos aim to enhance interoperability between different blockchain networks, allowing seamless communication and transactions across various platforms. This will allow DeFi apps to scale faster and more efficiently.

Regulatory Evolution and Clarity

One of the most crucial aspects of the future of DeFi is regulatory clarity. As the global landscape evolves, many countries are creating frameworks to regulate cryptocurrencies. This is helping to foster trust and certainty in the space, encouraging businesses to adopt crypto payments with confidence.

Countries like the United States, the European Union, and Singapore are taking significant strides toward clear regulation, which will make it easier for businesses to navigate the legal landscape. Regulations will also help combat fraud and money laundering, ensuring that crypto payments remain secure and trustworthy.

Improved Security Measures

Security is a top priority in DeFi, and ongoing advancements are being made to enhance the safety of crypto transactions. For example, innovations such as multi-signature wallets, decentralized identity verification, and secure multi-party computation are ensuring that transactions remain safe and resistant to cyber threats.

These new security protocols further bolster the confidence that businesses need to fully integrate crypto payments into their systems. As technology evolves, the security of blockchain networks will continue to improve, making crypto payments even more attractive for businesses.

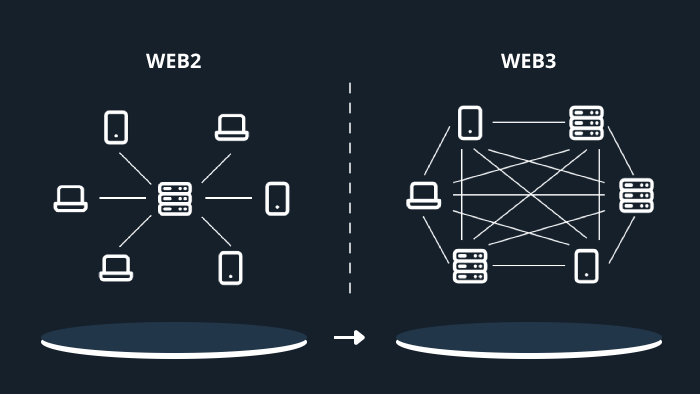

Bringing Web2 and Web3 Together

The convergence of traditional finance (Web2) and decentralized finance (Web3) is another exciting development in the crypto payment space. Major players like 1inch and MasterCard are collaborating to bridge the gap between these two ecosystems. This integration will enable businesses to leverage the established infrastructure of traditional finance alongside the innovative, decentralized solutions provided by blockchain technology.

As Web2 and Web3 collaborate, we can expect to see a more unified and inclusive financial system that combines the best of both worlds. This fusion of technologies will expand the accessibility, reach, and efficiency of DeFi payments, allowing businesses to innovate without worrying about technical barriers.

Conclusion

So now you’ve reviewed about The Future of DeFi Payments: Opportunities for Businesses in 2025. KwickBit hopes this article will provide you with more useful information.

The future of DeFi in payments is bright, with continuous technological advancements driving greater adoption and efficiency. As blockchain solutions like Layer 2, sharding, and interoperability protocols mature, businesses will find it easier and more cost-effective to integrate crypto payments into their operations. Regulatory clarity and improved security will further boost confidence, making the transition to DeFi payments even more appealing.

By embracing decentralized finance, businesses can unlock numerous benefits, including enhanced security, lower transaction fees, faster cross-border payments, and access to new global markets. The future of finance is decentralized, and businesses that adapt to these changes early will position themselves for long-term success in a rapidly evolving digital economy.

KwickBit – Non-custodial Payment Gateway

Read more: