Bitcoin’s fourth halving event in 2024 has become a pivotal moment for the cryptocurrency market. This event, where the reward for mining new blocks is reduced by half, dramatically affects the supply of Bitcoin, creating scarcity and potentially driving demand. But what does this mean for businesses?

In this blog, we will explore the post-halving market dynamics, how businesses can leverage Bitcoin in this evolving landscape, and why now is the ideal time to embrace Bitcoin as a payment method. Uncover insights with KwickBit!

Understanding Bitcoin Halving: What Does It Mean for the Market?

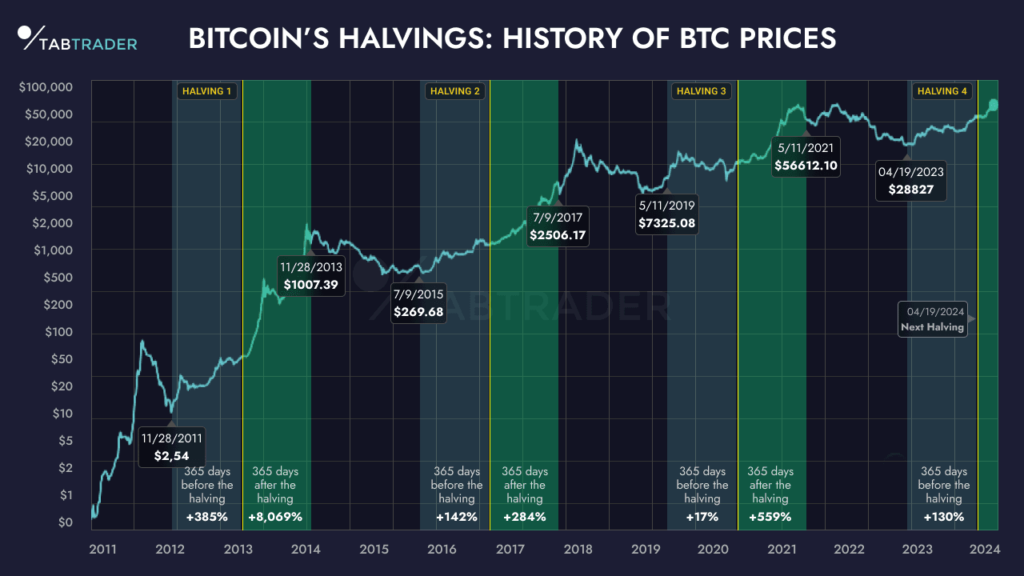

Bitcoin halving events are crucial in controlling the cryptocurrency’s inflation rate. Every four years, the reward for mining Bitcoin gets cut in half, limiting the supply of new coins entering circulation. The 2024 halving further tightens this supply, potentially increasing Bitcoin’s value over time as scarcity kicks in.

For businesses, this mechanism can offer a window of opportunity to embrace the growing digital economy and adopt cryptocurrency as a payment option. Understanding this process is key to unlocking the many benefits Bitcoin has to offer.

The 2024 Halving: Key Differences and Industry Shifts

While Bitcoin halving events are nothing new, the 2024 iteration presents some notable changes in the market:

Spot Bitcoin ETFs Approval

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved multiple spot Bitcoin exchange-traded funds (ETFs), making it easier for traditional investors to gain exposure to Bitcoin without buying the cryptocurrency directly.

This move bridges the gap between traditional finance and digital assets, leading to increased institutional investment in Bitcoin.

Maturation of Bitcoin Mining

The Bitcoin mining landscape has matured significantly. With reduced Bitcoin rewards, miners must focus on efficiency and innovation. Publicly traded mining companies now dominate the sector, and with the availability of regulated Bitcoin futures and options markets, they have better hedging options to manage risk.

This development ensures the stability of the Bitcoin network, which is beneficial for businesses that choose to integrate Bitcoin into their payment systems.

Bitcoin Ordinals and Runes: A New Frontier

Bitcoin Ordinals and Runes represent an exciting evolution in the world of digital assets. Ordinals are unique, non-fungible tokens (NFTs) on the Bitcoin blockchain, and Runes enable the creation of fungible tokens. These developments expand Bitcoin’s use case, paving the way for new digital collectibles and decentralized finance opportunities.

Businesses can tap into these innovations to offer digital products and services that resonate with modern consumers.

How Businesses Can Capitalize on Bitcoin After Halving

The 2024 Bitcoin halving presents several opportunities for businesses. Here’s how you can benefit:

Diversify Payment Methods

By accepting Bitcoin, businesses can diversify their payment options, providing customers with more flexibility. As Bitcoin gains mainstream acceptance, offering it as a payment method can help you tap into a growing market of cryptocurrency enthusiasts and investors. This also acts as a hedge against inflation and fiat currency devaluation.

Attract New Customers with Digital Currency

Bitcoin appeals to a younger, tech-savvy demographic. By adopting Bitcoin payments, businesses signal that they’re forward-thinking and innovative. This can help you attract new customers who are eager to support brands that align with their values of decentralization and financial independence.

Benefit from Borderless Transactions

Bitcoin operates on a global, decentralized network. By accepting Bitcoin, businesses can easily process international payments without the need for costly currency conversions or dealing with cross-border banking restrictions. This can help expand your customer base and streamline international transactions.

Future Trends: What’s Next for Bitcoin and Businesses?

Looking ahead, there are several key trends that businesses should keep an eye on:

- Increased Institutional Adoption: As more institutional investors enter the cryptocurrency market, Bitcoin will likely see greater stability and credibility, making it an even more attractive option for businesses.

- Regulatory Clarity: With more governments and regulators working to define the rules around cryptocurrency, businesses can expect a more secure and structured environment for accepting Bitcoin.

- Bitcoin as a Store of Value: As Bitcoin becomes more recognized as a hedge against inflation, its role as a store of value will likely continue to grow. Businesses that accept Bitcoin could position themselves as leaders in the adoption of this asset class.

Conclusion

So now you’ve reviewed about Maximizing Business Opportunities After Bitcoin Halving in 2024. KwickBit hopes this article will provide you with more useful information.

The 2024 Bitcoin halving is more than just a technical event—it’s an inflection point for the cryptocurrency industry. With Bitcoin’s supply becoming more limited, its value proposition becomes even stronger. For businesses, this presents a golden opportunity to embrace innovation, diversify payment methods, and attract a new customer base.

By understanding the market dynamics and taking action now, businesses can position themselves at the forefront of the digital finance revolution and make the most of Bitcoin’s growing adoption.

KwickBit – Non-custodial Payment Gateway

Read more: