France continues to position itself as a leader in cryptocurrency regulation, aligning with the European Union’s Markets in Crypto Assets (MiCA) framework and introducing measures to foster trust, transparency, and security in the digital asset space.

Whether you’re an investor, trader, or business owner, understanding France’s crypto tax policies and regulatory environment is crucial. Uncover insights with KwickBit!

Enhanced Crypto Regulations in France

France’s financial regulator, the Autorité des marchés financiers (AMF), has adopted robust standards for Digital Asset Service Providers (DASPs) under the MiCA regulation, which became effective across Europe in mid-2023. These measures aim to create a safer environment for digital transactions:

- Advanced Security Controls:

Providers must implement strong security frameworks and manage conflicts of interest to safeguard client assets effectively. - Transparent Pricing Policies:

DASPs are required to publicly disclose pricing policies, ensuring users can make informed decisions with clear cost structures. - Protection of Client Assets:

Firms are prohibited from using client funds without explicit prior consent, bolstering confidence in the system.

By prioritizing security and transparency, these regulations help strengthen trust in the digital asset market while protecting users from potential risks.

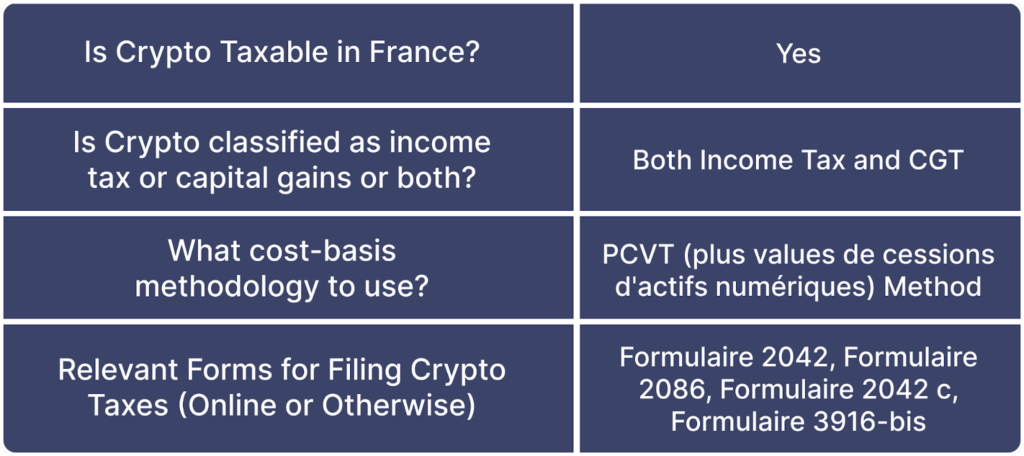

Crypto Taxation in France

The General Directorate of Public Finances (DGFiP) categorizes cryptocurrency as moveable property, similar to stocks and bonds. While not recognized as legal tender, crypto is widely accepted as a medium of exchange. Below are the key highlights of France’s tax policies:

Taxable Events

- When Tax Applies:

- Converting crypto to fiat currency.

- Profits from activities like mining.

- When Tax Does Not Apply:

- Crypto-to-crypto transactions.

- Transfers between personal wallets.

Flat Tax Rate

Since January 1, 2023, France applies a 30% flat tax to all crypto sales. This unified rate eliminates distinctions between professional and occasional traders.

Capital Gains Calculations

The tax on crypto gains is calculated with considerations for:

- Acquisition costs of the crypto assets.

- Expenses directly related to the sale.

Accurate documentation is critical, as detailed records can help minimize your tax burden and ensure compliance.

Can French Authorities Track Your Crypto Holdings?

Despite a common misconception, crypto is not entirely anonymous. Under the EU’s Sixth Anti-Money Laundering Directive, centralized exchanges are required to enforce strict customer identification rules. These regulations enable the sharing of user data across EU member states to combat tax evasion, money laundering, and other illicit activities.

If you fail to report your crypto taxes in France, you could face severe penalties, including:

- Fines: Up to €500,000.

- Imprisonment: Up to 5 years.

- Additional Penalties: Up to 80% of the unpaid tax amount.

Being proactive in reporting ensures compliance and avoids legal complications.

How Businesses Can Embrace Crypto Payments

Accepting cryptocurrency as a payment method can provide French businesses with new growth opportunities. Here’s why and how businesses can integrate crypto payments:

Benefits of Accepting Crypto

- Attract a Broader Customer Base: Cryptocurrency acceptance can appeal to tech-savvy customers and international clients.

- Lower Transaction Costs: Crypto payments often come with reduced fees compared to traditional payment methods.

- Fast Settlements: Blockchain technology enables near-instant transaction confirmations.

Steps to Accept Crypto Payments

- Set Up a Crypto Wallet: Choose a secure wallet for receiving payments. Hardware wallets are ideal for long-term storage.

- Select a Payment Processor: Use platforms that integrate seamlessly with your existing payment infrastructure.

- Enable Strong Security Measures: Implement two-factor authentication (2FA) and educate staff on secure handling of digital assets.

- Train Your Team: Ensure employees are familiar with the process of accepting and managing crypto payments.

By adopting cryptocurrency, businesses can stay ahead of the curve and capitalize on the growing digital economy.

Practical Tax Filing Tips for Crypto Investors

Filing crypto taxes in France doesn’t have to be daunting. Follow these tips to streamline the process:

- Track Every Transaction: Use crypto portfolio trackers or tax software to maintain a detailed record of trades, transfers, and conversions.

- Understand Your Taxable Events: Differentiate between taxable and non-taxable transactions to avoid overreporting.

- Consult a Tax Advisor: A professional can help you navigate complex rules, especially if you have a high volume of transactions.

- Stay Updated: Regulations evolve, so keep an eye on updates from the DGFiP and AMF.

Future of Crypto in France

As France solidifies its position as a crypto-friendly nation, several trends are worth watching:

- Greater Integration: Expect more businesses to accept cryptocurrencies as adoption rises.

- Innovative Regulations: France may continue to refine its regulatory framework to balance innovation with security.

- Global Collaboration: The alignment with MiCA indicates a push for standardized regulations across Europe, which could streamline cross-border transactions.

Conclusion

So now you’ve reviewed about Crypto Taxes and Regulations in France. KwickBit hopes this article will provide you with more useful information.

France’s proactive approach to crypto regulation and taxation reflects its commitment to fostering a secure and transparent digital economy. Whether you’re a trader, investor, or business owner, staying informed about these developments is essential to maximize opportunities and ensure compliance.

By embracing the evolving crypto landscape, France is setting an example for the rest of the world in bridging traditional finance with blockchain innovation.

KwickBit – Non-custodial Payment Gateway

Read more: